European tax on non-recycled plastic: Regulations and country-specific applications

In 2017, European countries were facing a serious problem: plastic pollution. Annually, approximately 26 million tonnes of this waste were produced across Europe, with only 30% being recycled. This had detrimental effects on the economies of the affected countries, as well as on people’s health and the environment. To address this problem, on 16 January 2018, the European Commission presented an EU strategy to reduce the use of plastics and promote the transition to a circular economy.

What has been done since 2018 to try to follow this European Plastics Strategy? One major development was the introduction of the plastic own resource on 1st January 2021. This resource serves as a new revenue stream for the EU for the period 2021-2027. Under this system, member states contribute a fixed amount to the EU budget based on their usage of non-recycled plastic packaging. The set rate for this contribution is 0.80 euros per kilogram of non-recycled plastic packaging waste.

In addition to this, each country was free to implement its own plastic tax system, as long as it complied with EU targets.

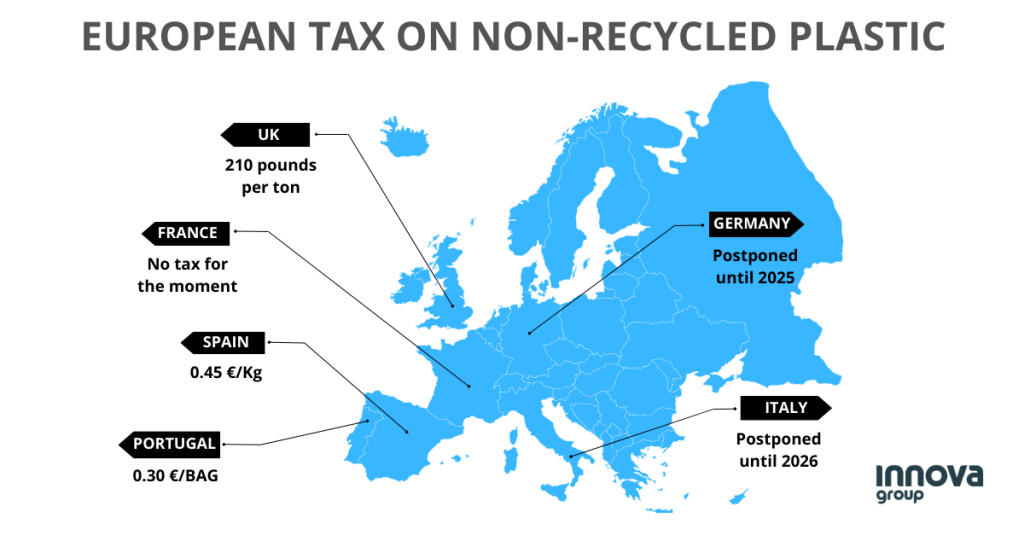

But how many countries have implemented new measures? The fact is that only a few countries, like Spain, have adopted and implemented a plastic tax, with varying degrees of success and not without controversy. However, each region has its own economic priorities, which is why the implementation of a plastic tax is being delayed year after year in most European countries.

Which countries in Europe pay a plastic tax?

Spain approved a tax of 0.45 euros per kilogram of non-recycled plastic in 2023

Spain has been working on this plastic tax for years. In 2018, a law was passed requiring shops and businesses to charge for plastic bags. Then, on January 1, 2023, Law 7/2022 on waste and contaminated land for a circular economy was enacted, which included a new tax on non-reusable plastic packaging.

The tax is still in force today, in 2024, and the tax rate is 0.45 euros per kilogram of non-recycled plastic. The objective is clear: to reduce plastic pollution and encourage reuse and recycling to comply with the 2030 Agenda and the Sustainable Development Goals (SDGs).

This tax aims to reduce plastic use and promote recycling, impacting production costs that are passed on to consumers in the form of higher prices. Companies have to adapt by optimizing and reducing plastic use, incorporating more recycled content into their products, or switching to alternative materials exempt from the tax.

Italy postpones plastic tax again until 2026

Italy was quick to approve a plastic tax in the 2020 Budget Law, with a rate equal to that approved by Spain in 2023, 0.45 euros per kilogram of non-recycled plastic. However, due to the arrival of the Covid-19 pandemic, and to avoid increasing the tax burden on companies during the looming economic crisis, successive budget laws have delayed the implementation of the tax.

Initially, it was expected this January 2024 would see the implementation of this tax of 0.45 euros per kilo of non-recycled plastic, as this was contemplated in the last Budget Law approved in 2023. But again, Italy announced in mid-May that it was postponing the measure for the seventh time, for another two years, until 1 July 2026.

Germany will not start paying the plastic tax until 2025

Germany is another country that, faced with difficulties in implementing this new law, continues to postpone its implementation. The law regulating the plastic tax was passed in May 2023 and was to come into force on 1st of January 2024. But recently, the German government communicated its decision to postpone the implementation of the plastic levy for manufacturers and importers until 1st of January 2025, ruling out its introduction this year.

In this situation, it is also unknown what the final fee per kilo of non-recycled plastic to be paid in Germany will be.

UK levies 210 pounds per ton tax on packaging with less than 30% recycled plastic

The UK government has been imposing a tax on non-recycled plastic packaging since April 1, 2022, despite no longer being part of the European Union. This measure aims to boost demand for recycled plastic and encourage higher levels of plastic waste recycling.

The measure affects packaging, both manufactured inside the UK and imported, whose non-recycled plastic content exceeds 30% of its composition. Initially, the levy was 200 pounds per ton on producers or importers of plastic packaging but, as the law envisaged, this figure was increased one year after it came into force to 210 pounds per ton.

France, no definite date for the implementation of a plastic tax

In 2018, the French Ministry of Ecological Transition intended to introduce a tax per kilogram of non-recycled plastic, but the measure was never formalized. To date, France is still not considering such a measure.

Although it is participating in the EU’s plastic-based own resource in 2021, as are all other member states, France has not taken the step to adopt such a tax. Lack of political consensus, administrative complexity, and concerns about its economic impact are some of the reasons why no plastic tax has materialised.

Portugal adopted in 2022 a 30 cents tax per non-reusable plastic packaging

The Portuguese Tax Authority has been applying a plastic tax since 2022, consisting of a fee of 0.30 EUROS per plastic packaging that cannot be reused, paid by the end consumer.

In June 2023, Portugal was also scheduled to ban the sale of ultra-lightweight plastic bags for the primary packaging or transport of fruit, vegetables and bakery products to commercial establishments. This ban was eventually halted and a fee similar to the one already applied in 2015 is now charged for plastic shopping bags, which cost 10 cents.

As we have seen, the implementation of a plastic tax in Europe has been a measure adopted unevenly across member countries. Since the launch of the European Plastics Strategy in 2018, and the subsequent creation of the plastics own resource in 2021, only some countries like Spain and Portugal have made significant progress with the adoption of specific taxes on non-recycled plastic.

Countries such as Italy and Germany have repeatedly postponed their implementation, and France has not considered it at all. This difference in the implementation of plastic taxes reflects the different priorities and economic challenges of each EU member state, as well as the complexity of achieving political and administrative consensus around this crucial measure for environmental sustainability.

Do you need advice on how to reduce the plastic packaging of your loads? At Innova, as packaging machine manufacturers with more than 20 years of experience, we can advise you on the choice of consumables and end-of-line packaging systems. Contact our technical team without obligation, we’ll be happy to assist you.